CarInsurance.com Insights

- You can switch anytime, not just at renewal, and you may qualify for a prorated refund to prevent you from losing money on unused premiums.

- Life changes like adding a teen driver, moving or getting married are ideal times to shop because your rate varies with your risk profile.

- Gather essential documents, such as your current declarations page and driver’s license number, before shopping around.

- Our survey found that 49% of drivers switched car insurers last year. Among people who switched insurers, 26% of drivers saved 10% or more on a new policy, and 29% saved 15% or more.

- We crunched the numbers and found that switching car insurance companies could help you save $694 annually.

Most people stay with the same car insurance company longer than they should — not because it’s the best fit, but because switching feels too much work.

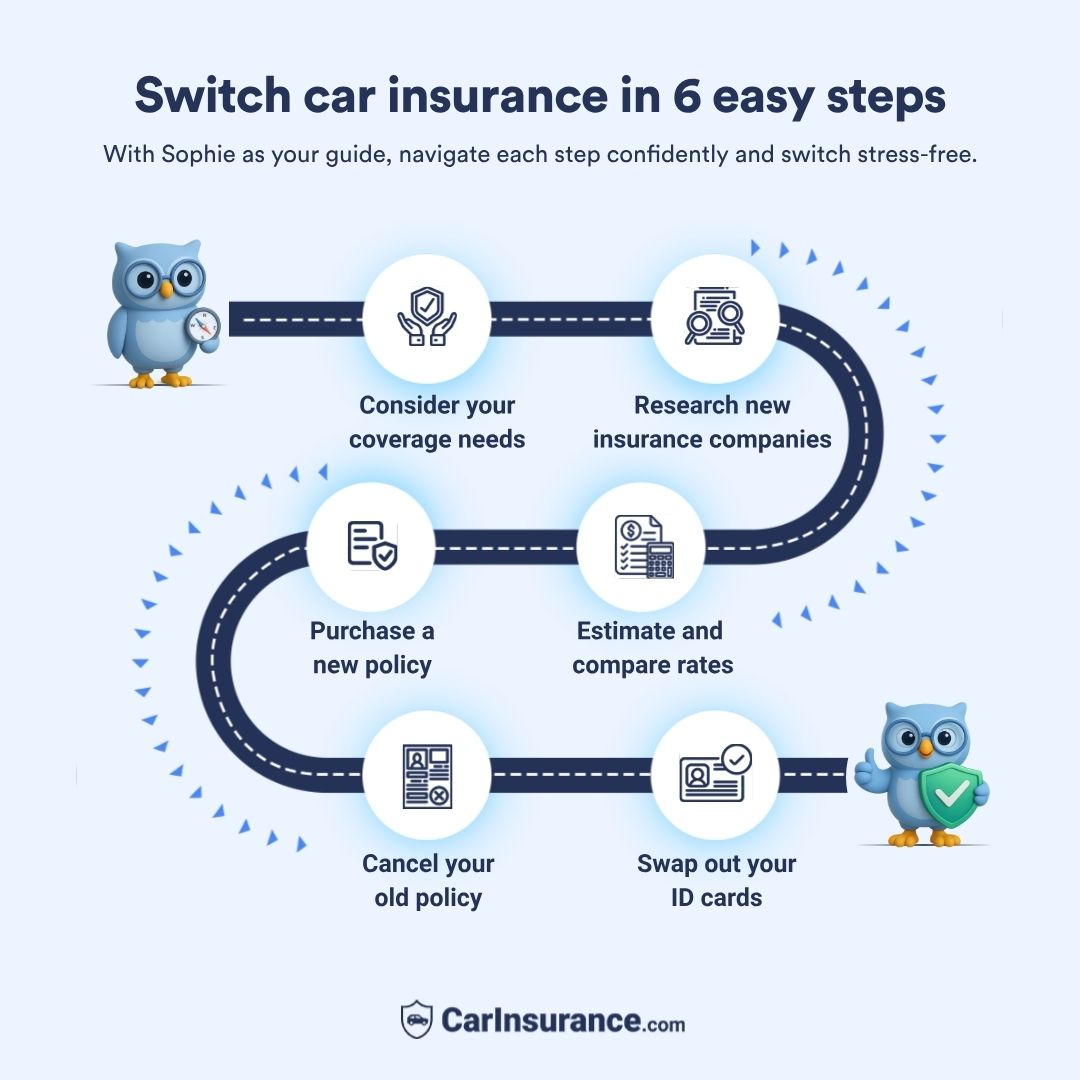

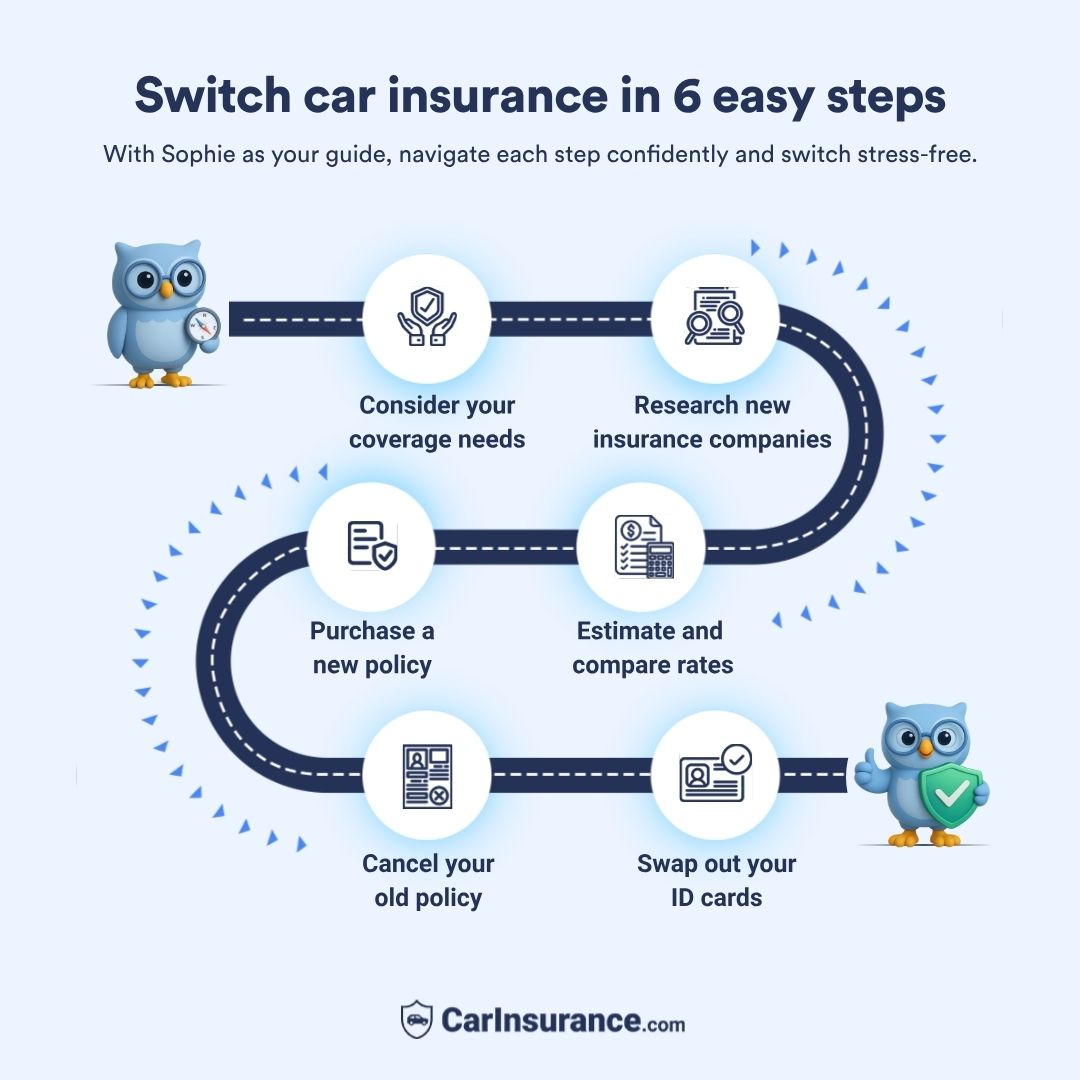

That’s where we step in. Our insurance experts mapped out a six-step process to help you confidently switch your insurer.

We’ll walk you through each step, from finding a new policy to cancelling your old one, so you can switch with confidence and ease.

Step‑by‑step: How to switch your car insurance company

Loyalty shouldn’t cost you money. If your circumstances have changed or your premiums have increased, it might be the right time to explore other options.

Let us walk you through the steps to switching auto insurance companies.

Step 1: Consider your coverage needs

Before making the switch, consider what you need from your policy. You should update your coverage limits or purchase different endorsements. For example, if you recently added a teen driver to your policy, you should get higher liability limits and add accident forgiveness for more protection in the event of an accident.

Step 2: Research new insurance companies

When looking at different insurers, don’t just focus on the cost. Consider factors like a company’s financial strength ratings, customer satisfaction, coverage options and how easy it is to manage your policy online or through an app. It also helps to read the reviews from people who’ve had policies with them.

Step 3: Compare quotes

Once you’ve identified a few insurance companies that could be a good fit for your needs, start getting personalized rate quotes.

CarInsurance.com’s coverage calculator can check estimated rates based on your ZIP code. Make sure to get quotes for the same type and amount of coverage, with the same deductibles, for an accurate comparison. Comparing quotes will help you find the best policy at the lowest price for your situation.

Step 4: Purchase a new policy

After you find the best new car insurance policy, you’re ready to purchase coverage. Most national car insurance companies allow you to buy a policy online without talking to an agent.

You’ll pay the first month’s premium or pay in full. Most policies go into effect starting at 12:01 a.m. the day after you buy the policy – make sure there is an overlap with your old policy.

Step 5: Cancel your old policy

You can cancel your old car insurance policy once the new policy takes effect. Your new policy must already be in effect before you terminate the old policy. Otherwise, you’ll have a lapse in coverage, which means you have no insurance coverage whatsoever. Most car insurance companies require customers to call an agent or the customer service department to cancel their coverage.

Step 6: Swap out your ID cards

The final step in switching car insurance is to replace your ID cards. Remove your old ID cards from your vehicle and replace them with new ones.

Can you switch car insurance companies at any time?

If you’re thinking about switching car insurance companies, you’re in luck — you can change carriers at any time, even outside the renewal period.

“You can switch car insurance at any time, even if your current policy hasn’t expired (in which case you should get a prorated refund)”

James Brau

Joel C. Peterson Professor of Finance at Brigham Young University

“However, it’s important to review any potential cancellation fees or penalties before making the switch to avoid unnecessary costs. If you switch, be sure you do not have a lapse in coverage between policies.”

Most insurance companies don’t charge an early termination fee, and you might be eligible for a refund on unused premiums. However, if you’re earning any customer loyalty discounts through your current insurer, you will lose them when you switch companies.

Suppose you prepaid $1,200 for a 12-month policy and switch carriers after six months. Your insurer would typically cancel the policy and refund the unused portion, in this case, around $600, as long as no cancellation penalties apply.

How often people switch insurers and how much they save

CarInsurance.com surveyed drivers nationwide about car insurance. The survey found that 49% of drivers shopped for a new car insurer in the past 12 months. Of people who switched insurers, 26% of drivers saved 10% on a new policy, and 29% of people saved 15% on a new insurance policy.

Best time to switch your car insurance

Car insurance rates aren’t set in stone. A policy that worked last year might not be the best option now.

“It’s always a good idea to shop around when you have a major change in your life, such as getting married or when your teens begin to drive,” says Brandt Minnich, vice president of marketing at Mercury Insurance, based in Los Angeles.

“Many parents expect to pay a little more when their kids begin driving, but they are often shocked when they see the actual cost.”

Let’s look into life changes that make shopping for car insurance a good idea.

Switch car insurance companies at renewal time

Renewal time is an excellent opportunity to review your insurance coverage. Usually, your current insurer will send you a reminder when it’s time to renew. If your rates are headed up at renewal time, you can find the best cheap car insurance for your situation by comparing quotes.

“Insurance companies use different algorithms to rate policies. One company may provide a better rate for a teenage driver than another, while another company rates elderly people better,” says Daniel Shipman with Daniel Shipman Insurance in Texas.

When you’re moving

If you’re moving to a new address, you need to notify your current insurer of the address change, so you might as well shop for a new policy. Let your insurer know if you’re going from an apartment to a house. Homeowners often get better rates because insurers believe they get into fewer accidents and file fewer claims than renters.

Car insurance rates vary drastically by state. The most expensive states are Louisiana, Florida and Washington, D.C. The annual full coverage rates for these states are shown below.

- Louisiana: $4,180

- Florida: $3,852

- Washington, D.C.: $3,394

- Nevada: $3,284

- Colorado: $3,222

Vermont, New Hampshire and Maine are the cheapest states for car insurance. The annual rates for these states are shown below.

- Vermont: $1,504

- Maine: $1,650

- New Hampshire: $1,701

- Hawaii: $1,721

- Ohio: $1,739

Use our “Will my insurance go up if I move?” tool to see how moving affects your auto rates.

When you add or drop a driver

Changes in your driver lineup will usually result in a rate change, making it an ideal time to shop for a new policy. If the new driver is a teen, expect your rates to skyrocket, especially for a male driver.

On the other hand, if a young adult is moving off your policy, you’ll likely see a significant drop in rates.

Anytime someone moves into or out of your household and has access to your cars, you should notify your insurers because it could impact your rates.

If your credit score drops

Insurance companies usually charge drivers with poor credit higher premiums, except in the states where that practice is forbidden: California, Hawaii, Michigan and Massachusetts.

“Most insurance carriers consider credit scores. Credit scores are typically weighted very heavily in insurance rates. If you’ve been tracking your score over time and have seen an improvement since the last time you compared quotes, it’s a great time to shop,” says R.J. Weiss, certified financial planner.

CarInsurance.com’s rate analysis shows that, on average, drivers with bad credit pay 115% more for auto insurance than those with good credit.

By comparing car insurance companies, drivers with bad credit can save $2,886, or $241 a month, on their yearly policy cost by comparing rates.

After a ticket or violation

Your car insurance rates will likely increase if you’re convicted of a moving traffic violation.

CarInsurance.com’s analysis shows that a speeding ticket increases rates by an average of 36%, depending on how fast you drive. Failure to stop, tailgating or making illegal turns also increases rates by about 28% annually.

While you’ll likely pay a higher premium regardless of your insurer after a ticket, insurance companies rate risk differently, so this is an excellent time to shop for new coverage.

After an accident

If you’re in an accident and make an insurance claim, your rates will increase unless your policy has accident forgiveness. An accident will increase your rate by an average of 58%, or about $1,458 per year.

While a recent accident usually results in a higher rate regardless of the insurer, shopping for cheap car insurance after an accident can minimize the increase.

After getting married or divorced

You should notify your insurer if there’s a change in your marital status. Statistics show married drivers are safer on the road, so you’ll get a discount if you’re tying the knot. You must get your spouse off your joint policy if the life change is a divorce.

When you buy a new car

A new car can significantly impact your premium. Insurers consider a vehicle’s safety rating, crash and theft statistics and claim rates when setting a premium. So, your new vehicle could be more expensive to insure.

Get a few insurance quotes before signing on the dotted line when shopping for a new car.

How to cancel your current car insurance policy

To cancel your car insurance, first make sure your new policy is already active so you don’t have a coverage gap. Once it kicks in, immediately contact your current auto insurer to cancel that policy.

You’ll typically need to request the cancellation in writing. Your insurer must report the cancellation to your Department of Motor Vehicles in many states. That means you should have the proper insurance in place beforehand.

Once you cancel, you should automatically receive a refund from your previous insurer if you’ve prepaid and are owed money, Minnich says, but you might be charged an early cancellation fee.

Common mistakes when switching insurance companies

Avoid these mistakes that can make switching insurance companies a financial nightmare.

Letting your coverage lapse

Never leave a coverage gap. You want to ensure your new policy is in place before you cancel your old policy. A coverage gap leaves you unprotected in an accident between policies. In other words, you’ll pay for all repairs and medical bills yourself.

“Many policies start at 12:01 a.m., so be sure you have coverage on any previous policy all the way until the new policy takes effect,” Herndon says. “An accident can happen anytime, and you don’t want a coverage gap to exist.”

Canceling without reviewing your old policy

Always compare the same coverage levels, deductibles and endorsements when shopping for a new policy. The best way to shop is to send your current declarations page to any insurer you are getting a quote from, which will ensure they match your current coverages.

Overlooking your refund after cancellation

If you’re switching mid-policy, your current insurer may owe you a refund. Most insurers process refunds quickly and easily. Cancel your policy and request a refund. Follow up if your refund isn’t issued promptly.

Delaying your insurance ID card swap

Don’t forget to switch out your insurance cards when you change insurers. Most auto insurers make printing your insurance ID cards easy, and many have an app that allows you to keep all your insurance details on your phone.

Failing to notify your lender about the switch

Contact your lender with the details of your new policy as soon as it goes into effect. If they get a notice from your old insurance company that you have dropped your coverage, they may repossess your vehicle. In other cases, they may “force place” a new policy on your car and bill you for it.

Driving recklessly during the transition

In the first 60 to 90 days of an insurance policy, the insurer can drop your coverage with few repercussions. So, drive carefully and avoid any tickets or accidents.

When you shouldn’t switch your car insurance company

Switching car insurance isn’t always the right move. In some situations, staying with your current insurer can save you money. Here are a few times when it makes more sense to hold off on switching.

- You’d lose loyalty perks: Some insurers reward long-term customers with accident forgiveness or special discounts. If you leave, you’ll lose those benefits and may pay more in the long run.

- You have an open claim: If you’ve recently had an accident and the claim hasn’t been settled, it might not be a good idea to switch until it’s resolved. A new company won’t handle that claim, and switching mid-process can cause a delay.

- Your policy has cancellation fees or penalties: Some insurers charge a cancellation fee if you end your policy early. Sometimes, the penalty can wipe out the savings you’d gain from switching. Always check the terms of your current policy before making a move.

- The savings aren’t significant: Switching may not be worth the hassle if the quotes you’ve gathered only save you a few dollars each month. Switching insurers pays off only when the new policy costs significantly less or offers better coverage for the same price you already pay.

What’s the right move for you?

The answer depends on your situation.

If your premiums are climbing, your coverage no longer fits or you’re unhappy with the customer service, switching could give you a fresh start and real savings.

But if your policy perks outweigh the new policy’s offers, there’s no harm in holding off. Either way, you’re in control of the decision.

Frequently asked questions about switching car insurance

Is it bad to switch auto insurance companies?

No. Switching car insurance companies isn’t a negative as long as you find a company that will save you money and offer you sufficient coverage. You also want to ensure switching companies doesn’t cause a lapse in coverage. Going without auto insurance for an extended time could result in you paying higher premiums once you get coverage again.

Does switching car insurance affect credit?

No, switching car insurance companies won’t hurt your credit. Comparing quotes doesn’t trigger a credit check like applying for a credit card. Those with bad credit usually pay more for car insurance than those with good credit. Insurers view a person’s credit history as a risk indicator.

Will my new insurance company cancel my old insurance?

If you switch insurance companies, your new insurer can’t cancel your old policy on your behalf. You will need to contact your old insurance company and request the cancellation. Sometimes, the policyholder is required to submit the request in writing. You might also need to show proof of your new policy to your old insurance company before you can cancel.

Can I change car insurance before the renewal date?

Yes. You can change car insurance companies before your policy’s renewal date. Typically, you can cancel your policy and switch companies at any time. If you paid your premium upfront, most insurers will also give you a refund on the unused premiums when you cancel your policy.

Resources & Methodology

Methodology

CarInsurance.com editors collected rates from Quadrant Information Services for a 40-year-old male and female driver carrying a full coverage insurance policy with limits 100/300/100 and $500 comprehensive and collision deductibles. Read the detailed methodology for more information.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs