When an insurance company declares a car totaled, it means the cost of repairing the vehicle exceeds a significant percentage of its value, according to the total loss formula, which varies by state. In such cases, the insurance company will compensate the policyholder for the car’s actual cash value and take ownership of the damaged vehicle.

Some policyholders may want to buy back their totaled car but find their insurance company won’t sell it back to them. Keep reading to learn why this happens.

CarInsurance.com Insights

- A vehicle is declared totaled when repair costs exceed 70-80% of its value, resulting in a salvage title with diminished resale value.

- Insurance companies often deny buyback requests due to the risks involved with driving a previously totaled car.

- If denied, consider using the claim amount to buy a similar vehicle or repair the car independently, ensuring it meets safety standards.

Understanding total loss and salvage titles

A car is considered totaled when the cost of repairs surpasses a certain threshold of its pre-accident value, typically around 70% to 80%. The exact total loss threshold depends on your state.

When this happens, the insurance company issues a salvage title, indicating that the car has sustained significant damage. Salvage titles carry substantial implications, including diminished resale value, potential safety concerns, and insurance implications.

Reasons insurance companies deny buyback requests

There are several reasons why an insurance company might refuse to let a policyholder buy back their totaled car. These reasons generally fall into three main categories: safety concerns, financial implications and legal/regulatory issues.

Safety concerns: One of the primary reasons insurance companies deny buyback requests is the risk associated with driving a previously totaled car. Even if repairs are possible, there is no guarantee that the vehicle will be restored to a safe and reliable condition.

Insurance companies are wary of potential liability issues if the repaired vehicle is involved in future accidents due to residual damage. They prioritize the safety of the driver and others on the road, which leads them to restrict the sale of these vehicles.

Financial implications: Allowing a policyholder to buy back a totaled car can be problematic for insurance companies. The cost of repairs often exceeds the vehicle’s value, making it an unwise financial decision.

Additionally, insurance companies may face potential losses if the vehicle, after being repaired, incurs more claims due to its compromised condition. By refusing buyback requests, they aim to mitigate these financial risks.

State laws: Legal and regulatory issues also significantly influence an insurance company’s decision. Different states have varying laws and regulations regarding salvage vehicles; some may have stringent requirements for repairing and re-registering a totaled car.

Insurance companies must comply with these laws to avoid legal complications. For instance, in Illinois, drivers cannot retain possession of a vehicle once it has been declared a total loss.

Why do some drivers want to keep their totaled cars

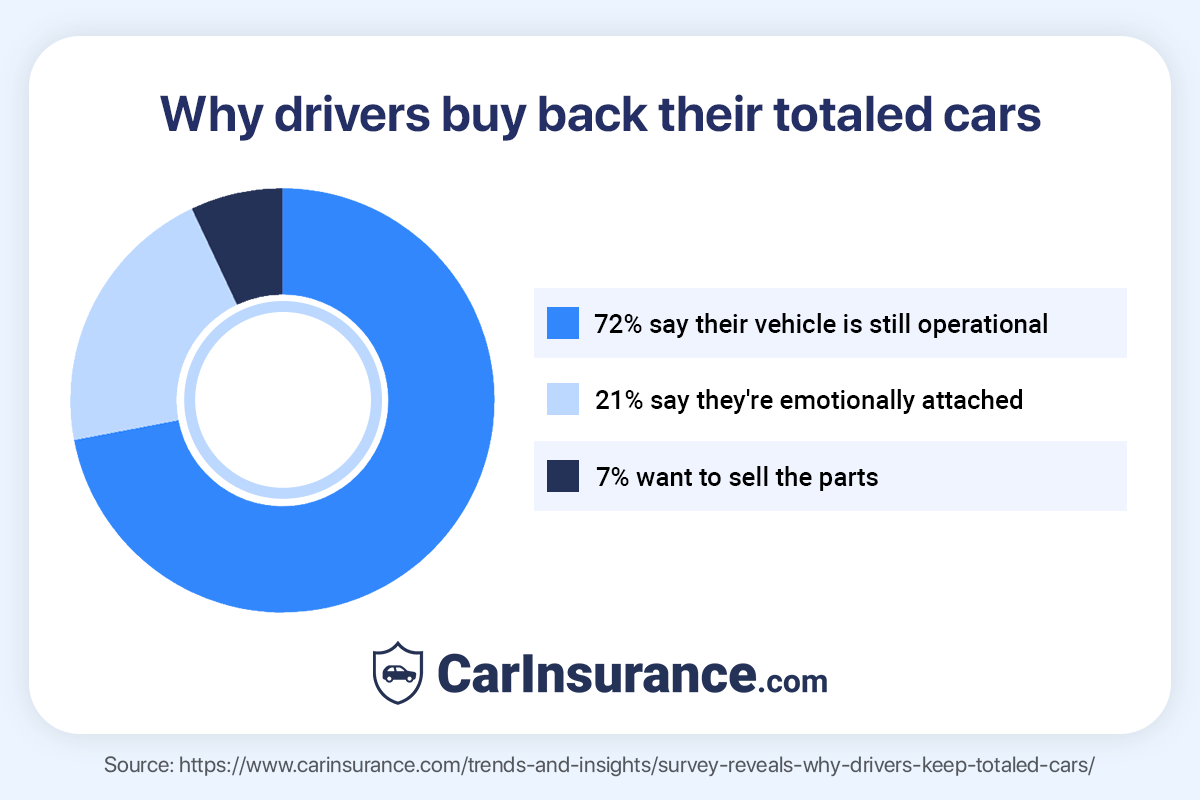

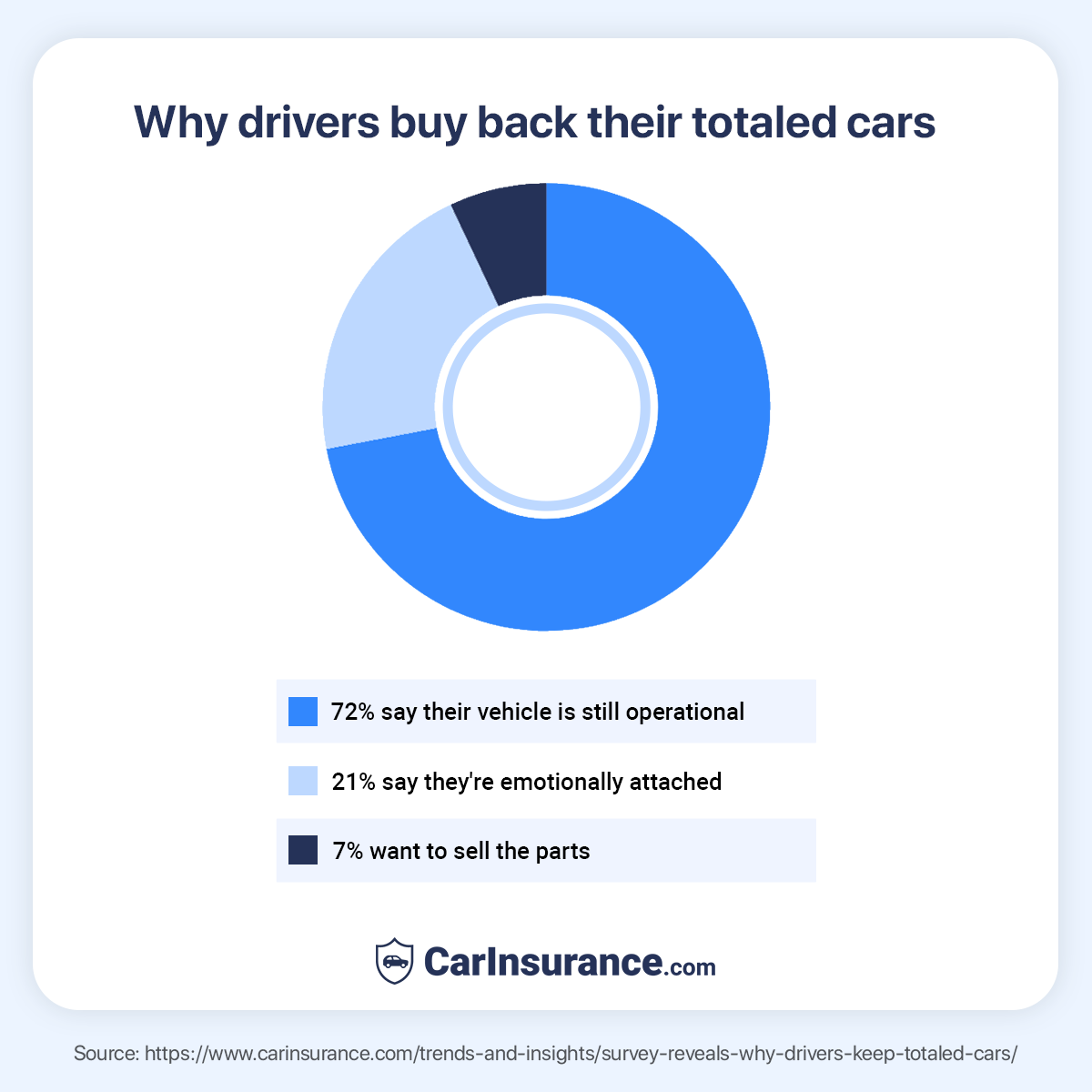

Insurers don’t always allow buybacks after a total loss, but many drivers are interested in keeping their vehicles. A CarInsurance.com poll found that 72% of respondents would repurchase their totaled car if it were still operational, while 21% said they kept theirs due to emotional attachment.

Even if a vehicle can be repaired, insurance companies may refuse to sell it back because of salvage title laws or the possibility that the car could return to the road in an unsafe condition.

Alternatives to buying back your totaled car

If an insurance company refuses your buyback request, consider exploring alternatives. One option is to purchase a similar vehicle with the compensation received from the insurance company. It ensures that you have a reliable and safe mode of transportation. Consider repairing the car independently to ensure all safety standards are met.

Read on to find out if you should consider buying back your totaled car

Resources & Methodology

Sources

- Kelley Blue Book. “Totaled Car” Accessed May 2025.

- Illinois Department of Insurance. “Illinois Insurance Facts.” Accessed May 2025.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs