CarInsurance.com Insights

- Progressive customers most appreciate the ease of accessing policy documents, digital tools and bundling discounts.

- Based on a recent analysis of car insurance companies, Progressive scored 4.22 out of 5 stars.

- Progressive ranked No. 1 for service satisfaction in J.D. Power’s U.S. Insurance Digital Experience Study.

Progressive has become a household name because of its memorable ad campaigns and characters (Flo and Jamie, anyone?). But brand familiarity doesn’t guarantee that an insurer will fit you best. Progressive is available across the U.S. and Washington, D.C.

To help you make that decision, CarInsurance.com’s Progressive Auto Insurance review surveyed current policyholders to determine how the company performed on key customer satisfaction criteria.

Progressive car insurance review

Progressive, a major insurer that covers drivers throughout the United States, ranked No. 5 among national carriers in our Best Car Insurance Companies for 2025 with a score of 4.22 stars out of 5.

The overall scores were compiled using rate data, NAIC scores, AM Best data, internal survey scores and J.D. Power data. The results are in the table below.

| Metric | Score |

|---|---|

| Customer satisfaction (out of 5) | 4.29 |

| NAIC (out of 1) | 0.707 |

| Average premium (out of 5) | 2.99 |

| Overall score (out of 5) | 4.22 |

| A.M. Best rating | A+ |

How Progressive stacks up against the competition

Based on a recent analysis of car insurance companies, Progressive scored 4.22 out of 5. That ranks it fifth out of the eight companies considered in the survey, with Travelers at No. 1. Nationwide was in second place, GEICO in third, and State Farm in fourth.

The table below highlights the scores earned by each company included in the study.

| 2025 Rank | Company | Overall Score |

|---|---|---|

| 1 | Travelers | 4.64 |

| 2 | Erie | 4.62 |

| 3 | Auto-Owners | 4.60 |

| 4 | Nationwide | 4.54 |

| 5 | GEICO | 4.50 |

| 6 | State Farm | 4.35 |

| 7 | American Family | 4.26 |

| 8 | Progressive | 4.22 |

| 9 | Amica | 4.16 |

| 10 | Farmers | 3.81 |

| 11 | Allstate | 3.75 |

Who is Progressive best for?

Drivers who want a fast, user-friendly digital experience — getting an online quote takes less than 10 minutes. It’s also a wise choice for those bundling home and auto policies, thanks to its wide range of discounts.

Progressive is particularly competitive for drivers with violations on their record. After a DUI, rates increase by 42% (from $1,933 to $2,753), which is lower than many competitors.

Premiums rise around 33% ($658) for drivers with speeding tickets, and for teen drivers with speeding violations, the increase is even more modest, at just 30%.

How Progressive scored in various categories

Progressive’s top categories in the consumer survey were ease of accessing policy documents and services, digital experience for website/app and auto/home bundling. Take a look at Progressive’s scores in various categories below.

- Customer satisfaction: 87%

- Ease of accessing policy documents and services: 91%

- Satisfaction with policy offerings: 85%

- Recommended to friends and family: 89%

- Trustworthiness: 91%

- Renewal rate: 93%

- Claims handling satisfaction: 81%

- Digital experience for website/app: 89%

- Discounts: 63%

- Fair rate increases over time: 75%

- Best for young drivers: 65%

- Best for senior drivers: 77%

- Best for drivers with tickets: 77%

Pros & cons of Progressive

Pros

- Wide availability: Offers coverage in all 50 states.

- Strong discounts: Large menu of savings, including homeowners, multi-policy and continuous insurance.

- Snapshot program: Telematics option rewards safe driving with potentially significant discounts.

- High-risk driver coverage: More willing than some competitors to insure drivers with DUIs, tickets or poor credit.

- Robust digital tools: Highly rated mobile app, Name Your Price tool and easy online quote/claims process.

- Customizable policies: Add-ons like loan/lease payoff, accident forgiveness, rideshare coverage and custom parts protection.

Cons

- Average satisfaction scores: Mixed reviews on claims experience compared to State Farm or USAA.

- Rates not always lowest: Can be more expensive than GEICO or State Farm for drivers with clean records.

- Snapshot risk: Unsafe driving tracked in Snapshot can actually raise your rates.

- Accident forgiveness is not automatic: You must qualify or pay extra, unlike some competitors that include it automatically.

- Regional variability: Pricing and service quality vary widely by state.

How much does Progressive car insurance cost?

Progressive wasn’t the cheapest company in CarInsurance.com’s rate analysis for full coverage or state minimum liability requirements.

Also, in some cases, you may pay a comparatively low base rate for coverage but then see a significant increase should you file a claim. In contrast, companies charging a higher annual rate may not hike your cost by that much if you get a ticket or have an accident.

While no one should choose a car insurance company based solely on price, smart shoppers know what to expect to pay and how it compares to the competition.

| Company | Monthly premium |

|---|---|

| Allstate | $209 |

| American Family | $142 |

| Amica | $185 |

| Auto-Owners | $129 |

| Erie | $123 |

| Farmers | $199 |

| GEICO | $147 |

| Nationwide | $129 |

| Progressive | $166 |

| State Farm | $165 |

| Travelers | $134 |

| USAA* | $115 |

*USAA is only available to military community members and their families.

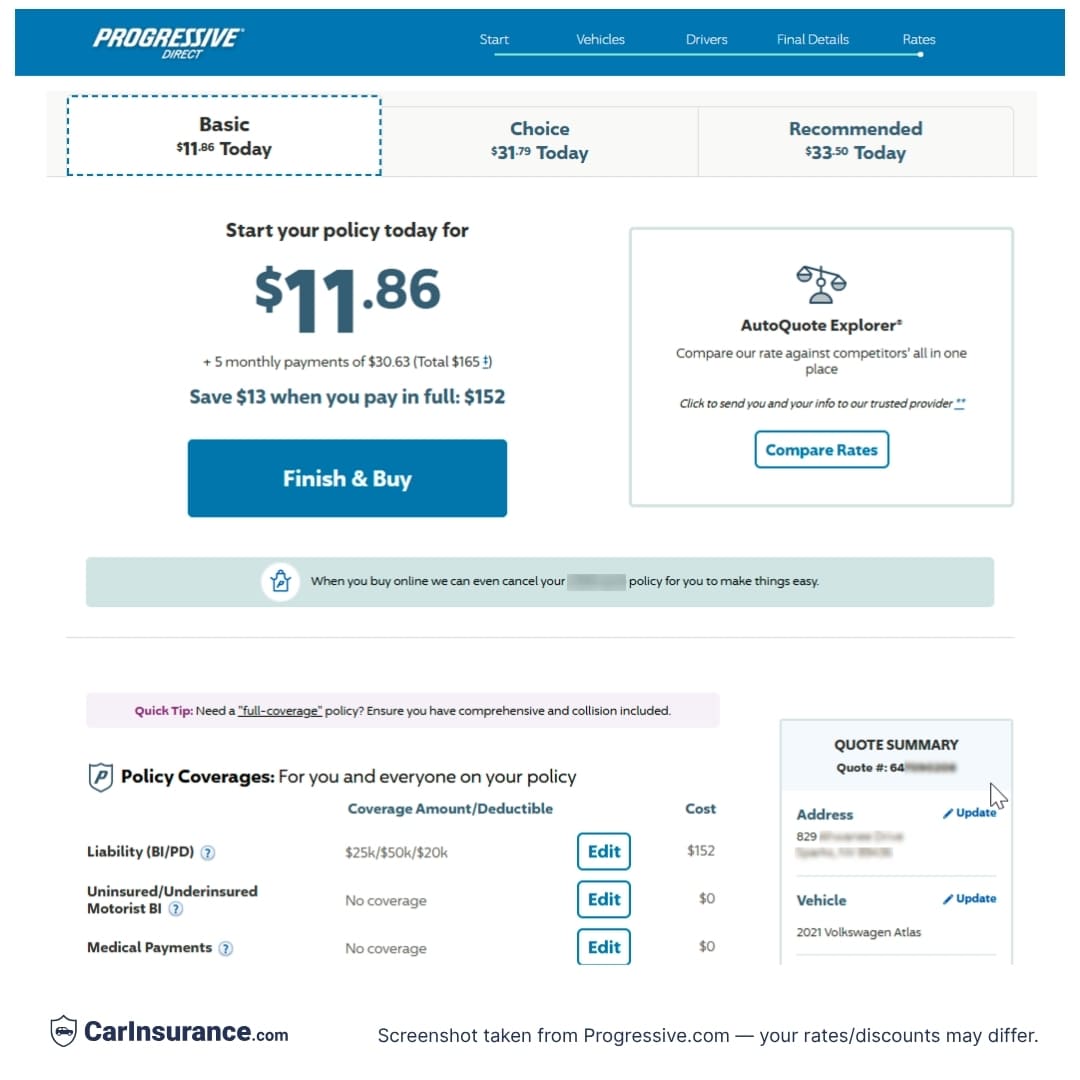

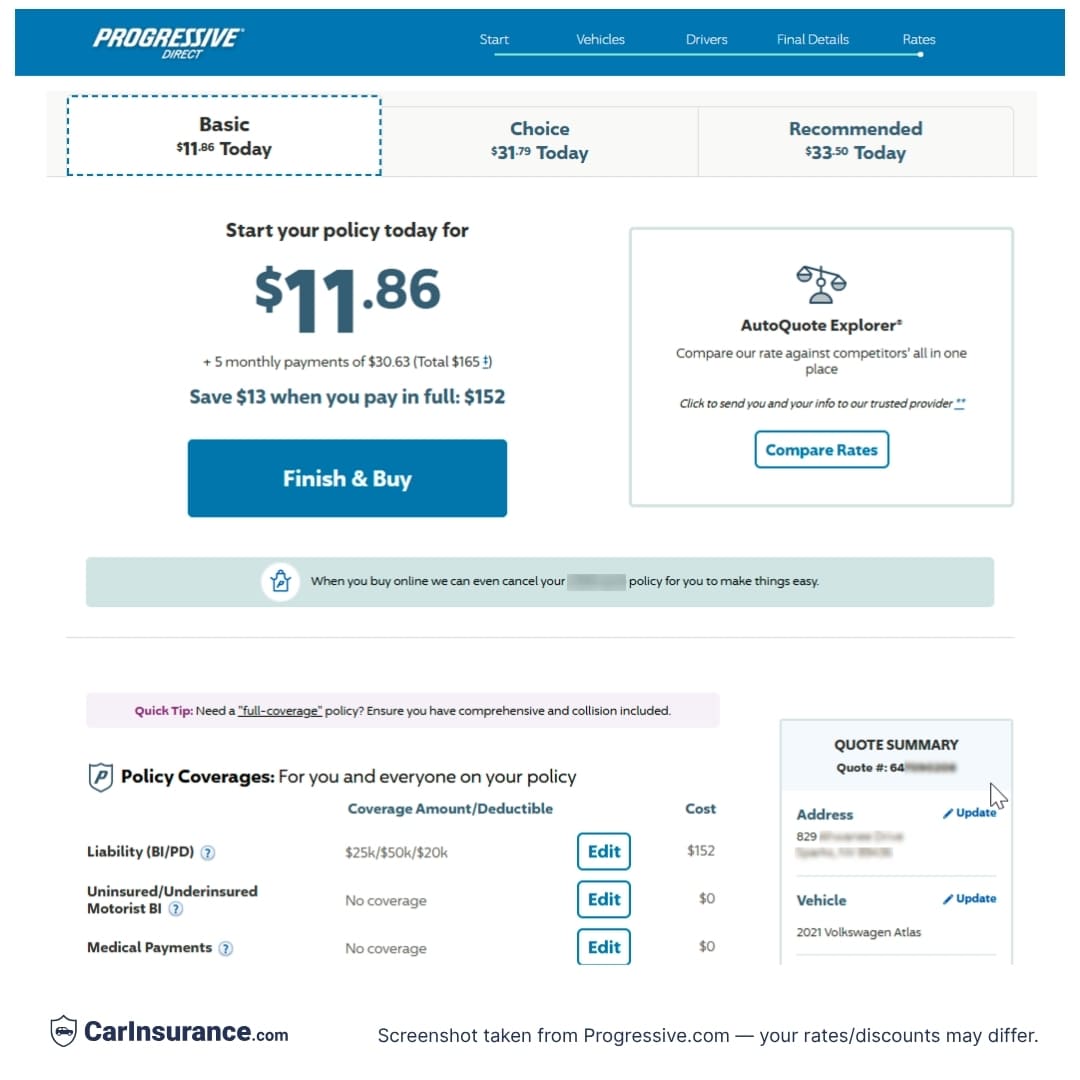

Laura’s personal experience getting a quote from Progressive

Getting a quote on Progressive’s website is easy and only takes about 10 minutes — you don’t even need your driver’s license number or your vehicle’s VIN.

Input your name, Social Security Number, address, job title, education level, home ownership status and the same information about any drivers in your household to start the process.

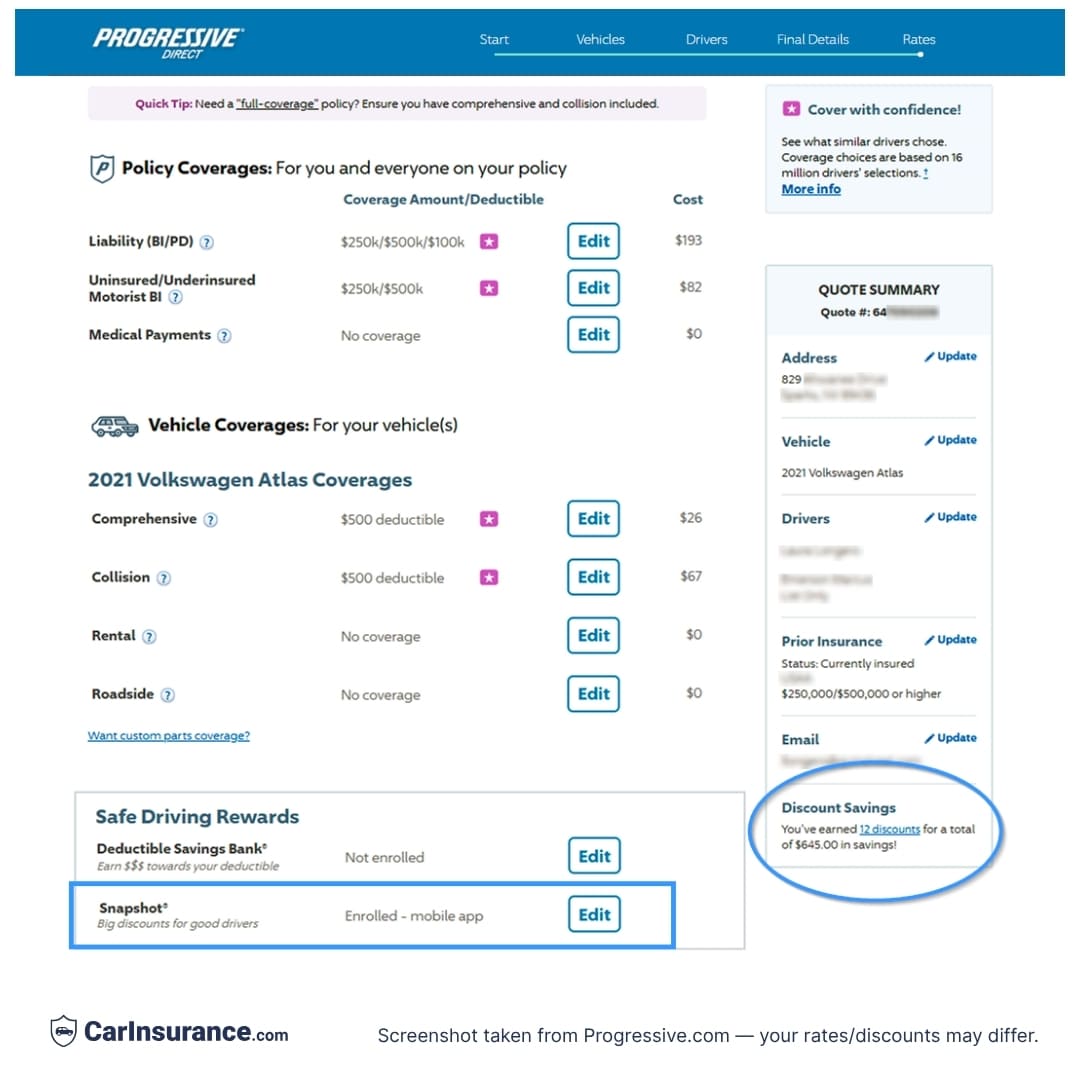

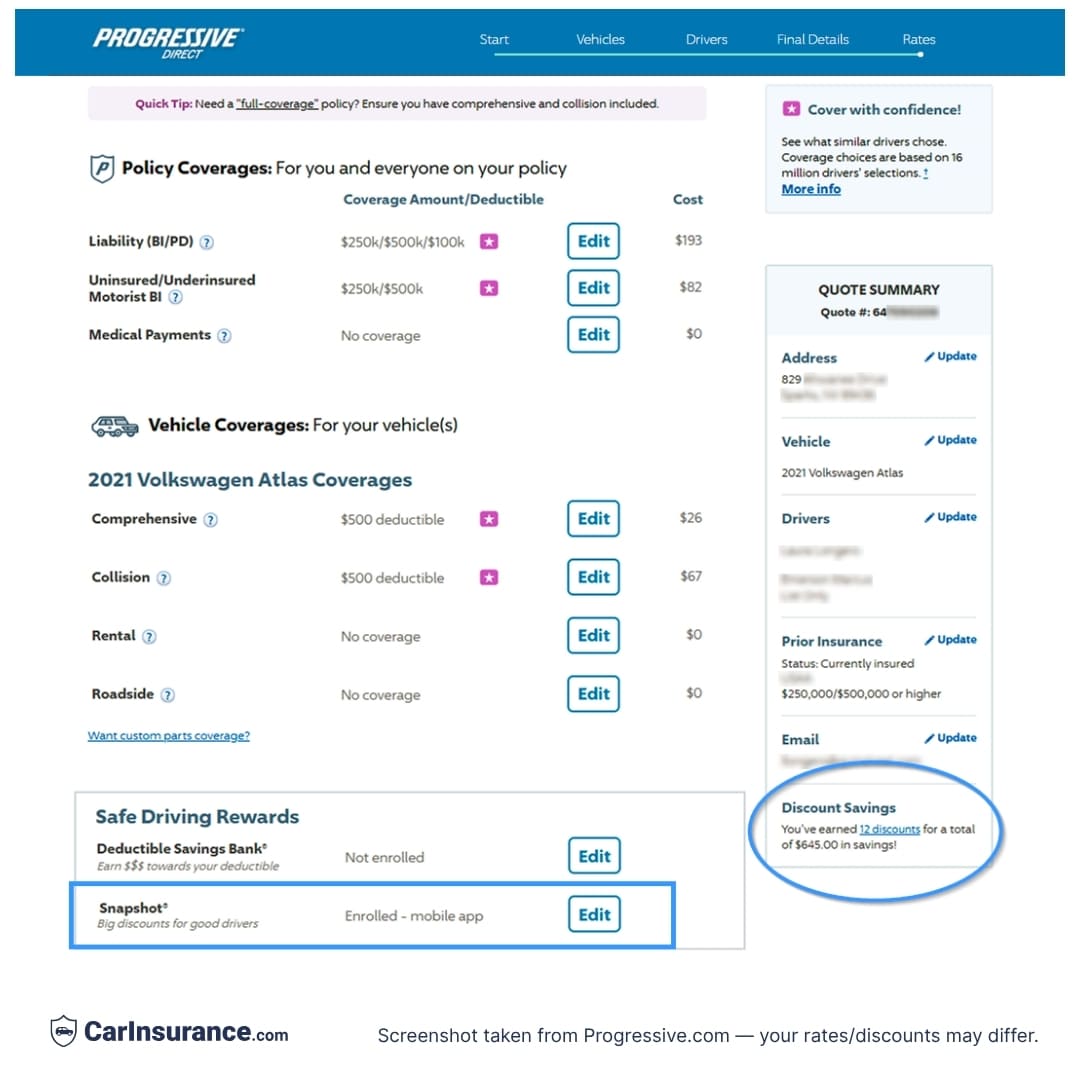

Next, you’ll add information about the vehicles you’re insuring. I got a quote in Nevada for my 2021 Volkswagen Atlas. Once I had input my name and address, Progressive automatically pulled in the details of my vehicle, which made the quote process go quickly.

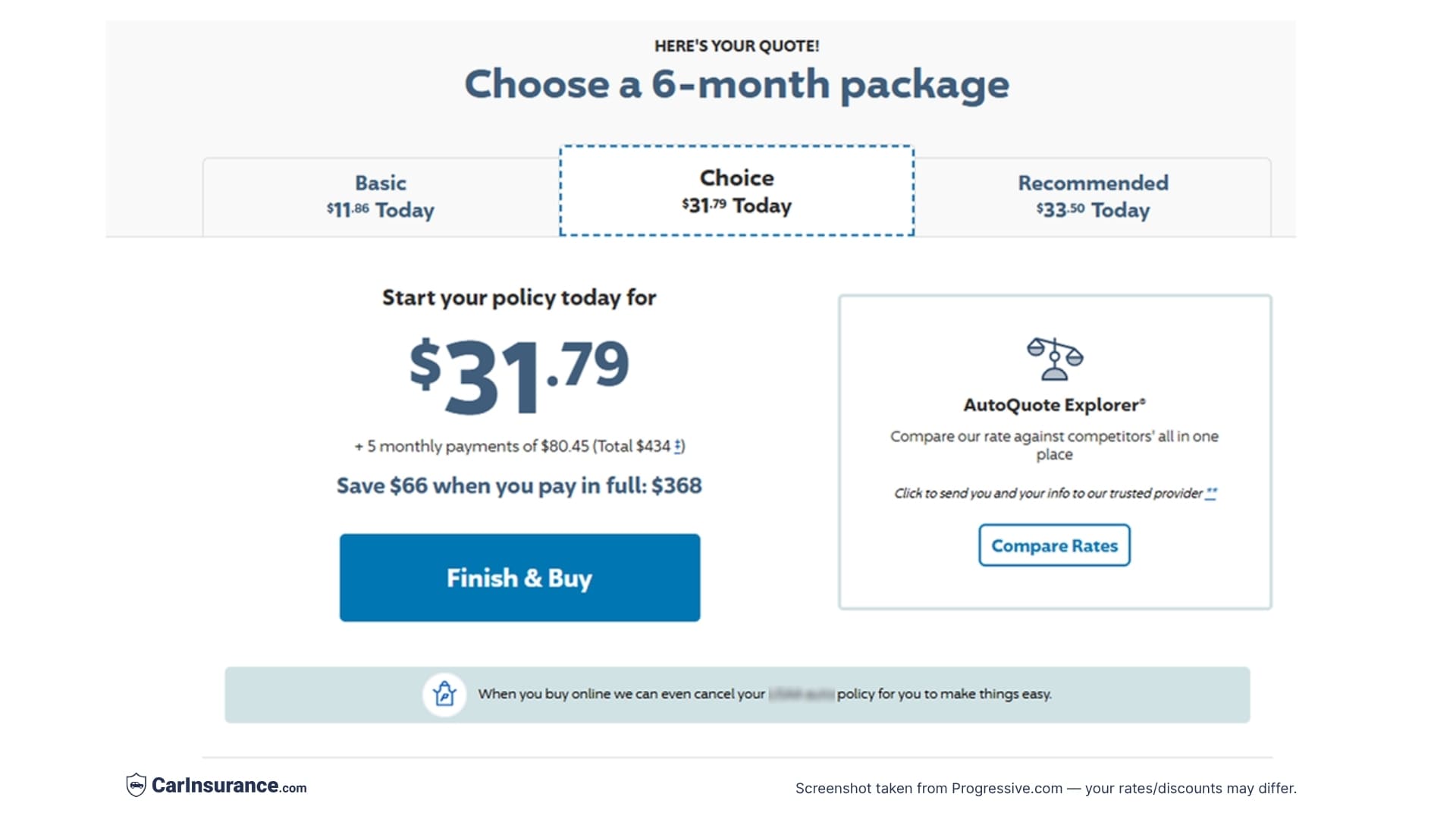

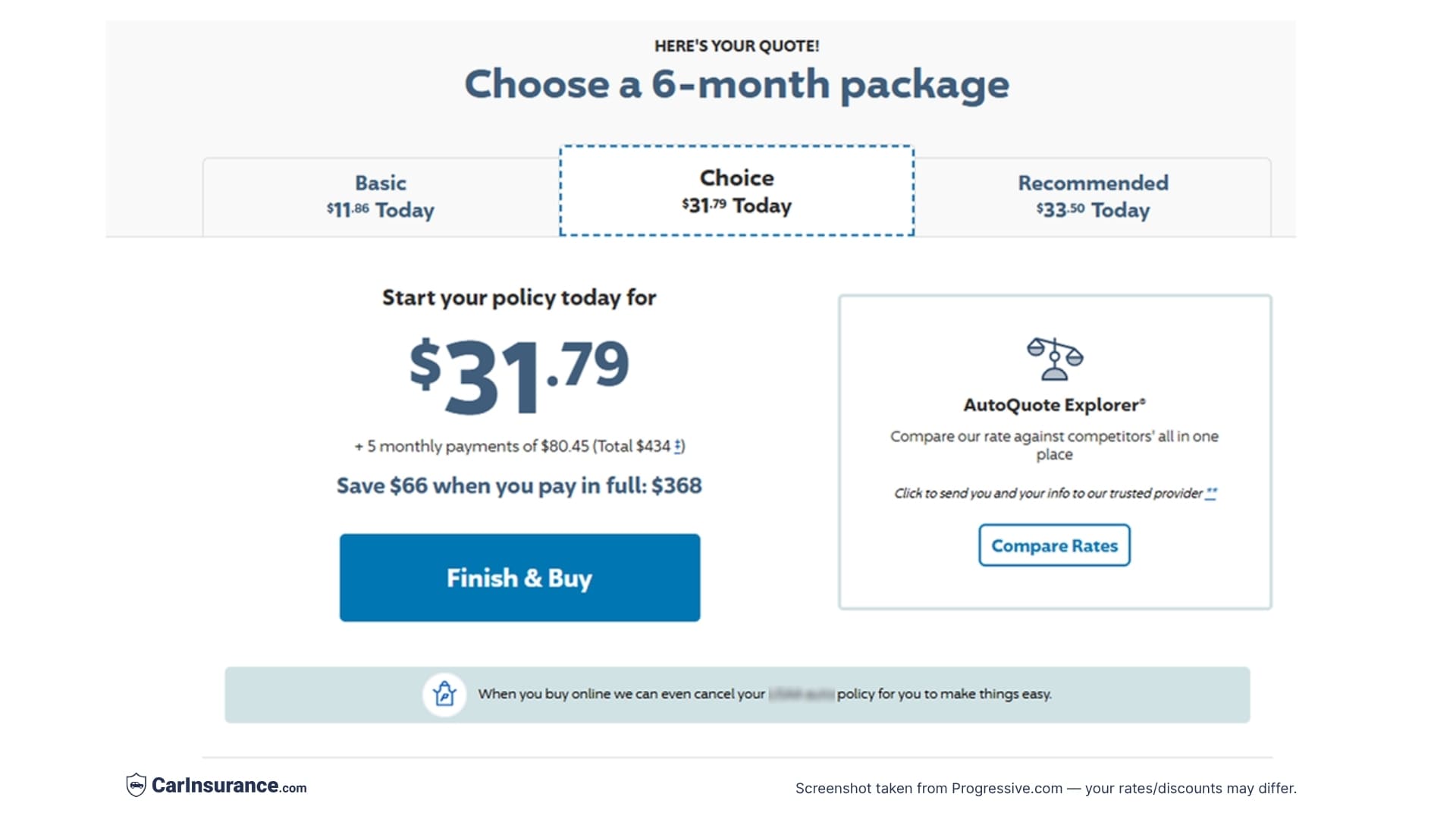

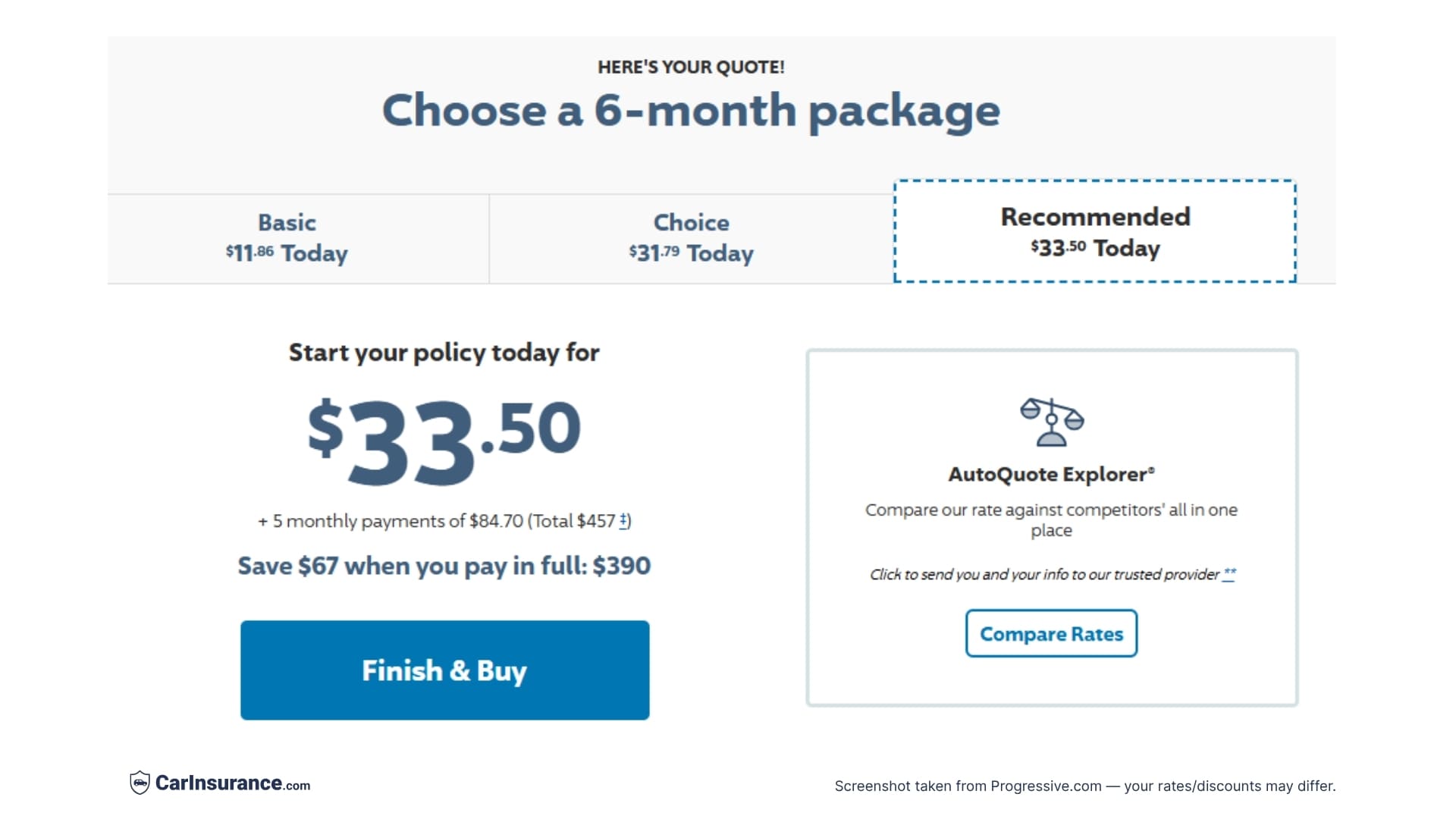

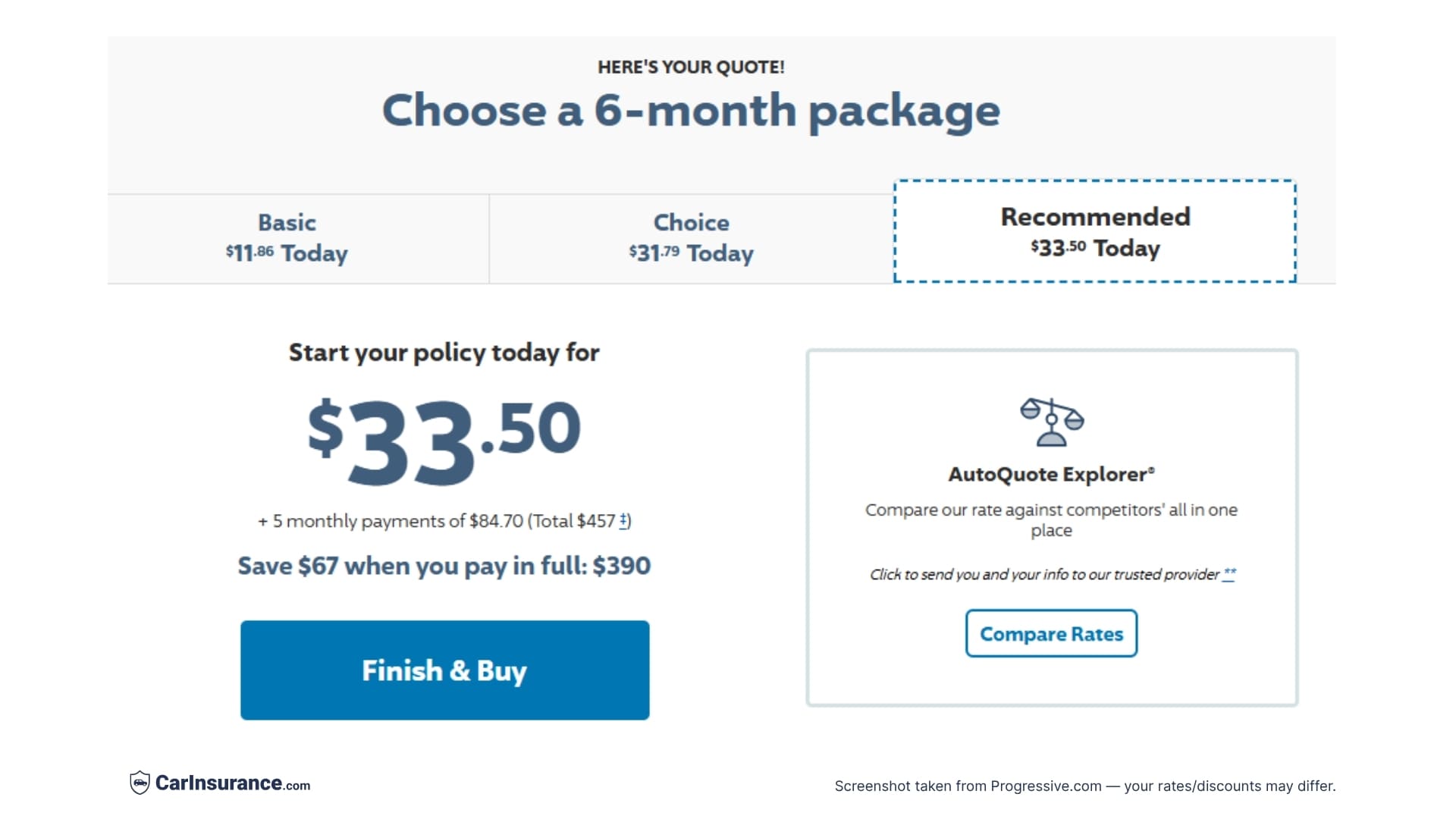

It gave me three options: Basic, choice and recommended.

Basic coverage is the state minimum in Nevada; I was quoted a rate of $152 for six months.

Choice had the exact coverages of my current USAA policy, including 250/500/100 liability coverage, collision and comprehensive coverage with $500 deductibles and 250/500 uninsured/underinsured motorist coverage. The choice policy rate was $368 for six months.

Finally, the recommended coverage level included 100/300/100 liability coverage with the same limits for UI/UM coverage, comprehensive and collision with $500 deductibles, medical payments of $1,000 per person, rental car coverage of $40 per day ($1,200 maximum) and roadside assistance. The recommended policy quote was $390 for six months.

Progressive car insurance discounts

Discounts I qualified for during the quote process.

- Multi-policy

- Continuous insurance

- Teen driver discount

- Accident forgiveness

- Snapshot safe driver discount

- Good student

- Distant student

- Homeowner discount

- Multi-car discount

- Online quote

- Sign online

- Paperless

- Pay in full

- Automatic payment

Mobile app rating

The Progressive insurance app has 4.8 stars out of 5 in the Apple App Store with 589,000 ratings.

It is No. 9 out of all finance apps.

User summary: “Users say the app is easy to use and navigate. They appreciate the convenience of making payments and filing claims. Additionally, users praise the app’s clear instructions and user-friendly design.”

The Progressive app’s rating on the Google Play Store is 4.6 out of 5 stars based on 210,000 reviews.

Frequently asked questions: Progressive

Is Progressive cheaper than other car insurance companies?

Progressive can be one of the more affordable options, especially for drivers with clean records or those considered high-risk. However, GEICO and State Farm often have lower average rates for many drivers. The best way to know is to compare quotes.

What discounts does Progressive offer?

Progressive offers a wide range of discounts, including multi-policy, multi-car, good student, continuous insurance, homeowners (even if your home isn’t insured with Progressive) and early signing. Its Snapshot program rewards safe driving with additional savings.

Does Progressive offer accident forgiveness?

Yes. Progressive offers both small accident forgiveness (for claims under $500) and large accident forgiveness (for customers who qualify by remaining claim-free for a set period). Availability may vary by state.

How do I file a claim with Progressive?

You can file a claim online, through the Progressive mobile app, by phone or with an agent. The company provides 24/7 claims reporting and tracks progress digitally.

How does Progressive rank in customer satisfaction?

Progressive has an average score in J.D. Power’s regional satisfaction studies and has a slightly higher-than-average NAIC complaint index. It has strong financial stability, with an A+ rating from AM Best.

Can I manage my policy online with Progressive?

Yes. Progressive has a robust online account system and mobile app that allows you to pay bills, access ID cards, file claims and track repairs.

Is Progressive a good insurance company overall?

Yes. Progressive is a top national insurer offering competitive rates, robust discounts, strong financial stability and innovative digital tools. It’s excellent for high-risk drivers and those who want usage-based insurance, though satisfaction scores are average compared to some competitors.

Resources & Methodology

Methodology

In the fall of 2024, We surveyed more than 1,750 insurance consumers (1,199 people with auto insurance). Online market research company Slice MR conducted the survey.

Respondents were asked to name their auto insurer and then grade it in the following categories:

- Customer satisfaction

- Ease of service

- Policy offerings

- Claims satisfaction

- Digital experience (website/app)

- Discounts offered

- Fair rate increases over time

- Insurance for young drivers/teenagers

- Insurance for college students

- Insurance for senior drivers

- Insurance for drivers with tickets or accidents

- Auto and home bundling

The percentage of respondents who said they were satisfied or very satisfied with their insurer is presented in the results.

We then asked respondents to provide a yes or no response to indicate their agreement with the following statements:

- I plan to renew with my current auto insurance company

- I would recommend my auto insurance company to others

- I trust my auto insurance company

The percentage of respondents who said yes is presented in the results.The editors compiled the survey results and then selected – based on the number of survey responses – the top companies for further evaluation.

They then collected AM Best data, which measure financial strength, and National Association of Insurance Commissioners’ complaint data, which ranks a company by the number of customer complaints it receives. Our team identified the NAIC codes of each underwriting company for each carrier and calculated a weighted average complaint index, weighted by the annual written premium. The associated NAIC complaint index score was used in the calculations.

They also collected insurance rate data from Quadrant Information Services.

With the help of Prof. David Marlett, Ph.D., Managing Director of the Brantley Risk and Insurance Center at Appalachian State University, the editors created a rating system to determine which insurance companies were best in each sector. For auto insurers, we took the following and gave each a weight.

- Survey: 40% of the total score (10% customer satisfaction, 10% recommended, 10% renewal rate and 10% claims handling)

- AM Best: 25% of total score

- Annual premium: 20% of total score

- NAIC: 15% of total score

Each insurer was awarded between half a star and 5 stars. No company in the ranking received less than half a star in any category, and 5 stars was the most any insurer could receive.

Get advice from an experienced insurance professional. Our experts will help you navigate your insurance questions with clarity and confidence.

Browse all FAQs